Assessing the Barbados SSB Tax

Assessing the Barbados SSB Tax

Evaluating and guiding policy decision-making in the Caribbean on the taxation of Sugar Sweetened Beverages

There is increasing international interest in using fiscal measures on food and non-alcoholic beverages as preventive measures for NCDs. A specific recommendation is to increase the tax on sugar sweetened beverages (SSBs), so that they are more expensive that non-sugar sweetened beverages. In the June Budget Statement in 2015 the Government of Barbados announced a 10% tax on SSBs, and this came into effect on September 1, 2015. The aims of the study are to evaluate the potential impact of a tax on SSBs in Barbados, develop methods that can be applied in other Caribbean countries to evaluate the impact of a tax on SSBs, and inform policy decision making on SSB taxes within the Caribbean region.

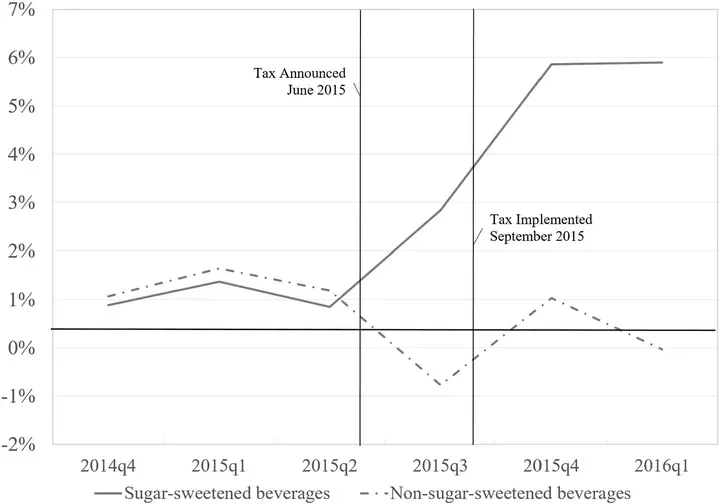

Prior to the tax, year-on-year price growth of SSBs and non-SSBs was very similar (approximately 1%). During the quarter in which the tax was implemented, the trends diverged, with SSB prices growing by almost 3% while prices of non-SSBs decreased slightly. The growth of SSB prices outpaced non-SSBs prices in each quarter thereafter, reaching 5.9% growth compared to <1% for non-SSBs.

Future analyses will assess the trends in prices of SSBs and non-SSBs over a longer period and will integrate price data from additional sources to assess heterogeneity of post-tax price changes. A continued examination of the impact of the SSB tax in Barbados will expand the evidence base available to policymakers worldwide in considering SSB taxes as a lever for reducing the consumption of added sugars at the population level.

Download our article on methods for assessing SSB taxation.

Download our article on price trends after SSB introduction.